Supply Chain trends, Cultural risks and the Technology with FP&A context

Understanding international relationships is crucial for the global supply chain. As globalization grows, supply chains become more intricate due to increased interactions between countries. By the end of 2024 and probably in 2025, supply chain logistics will evolve further, driven by technology and adaptability. Financial and planning analysis (FP&A) will optimize resilience and competitiveness. Market intelligence will help predict environmental changes, optimize supplier networks, and monitor competitors.

Supply Chain trends and cultural aspects risks

According to the 2024 trends report released by ASCM – Association for Supply Chain Management[1] , geopolitical aspects and the deglobalization of supply chains, where “geopolitical conflicts, including war, economic and technological competition and related security concerns, and the need for countries to mitigate the effects of climate change will continue to cause supply chain disruptions”, but according to the report both the probability of occurrence and the impact are low.

As a result, more regional supply chains will turn to simpler networks through nearshoring and friend-shoring, which are based on models of trust between nations that tend to share similar values and beliefs. This deglobalization may result in improved security and resilience; however, it’s also likely to raise prices, limit choice and reduce innovation due to smaller market sizes.

Cultural Aspects

However, with regard to the impact on probability, one must consider the characteristics of each nation involved in this relationship and the extent to which they influence the logistics chain.

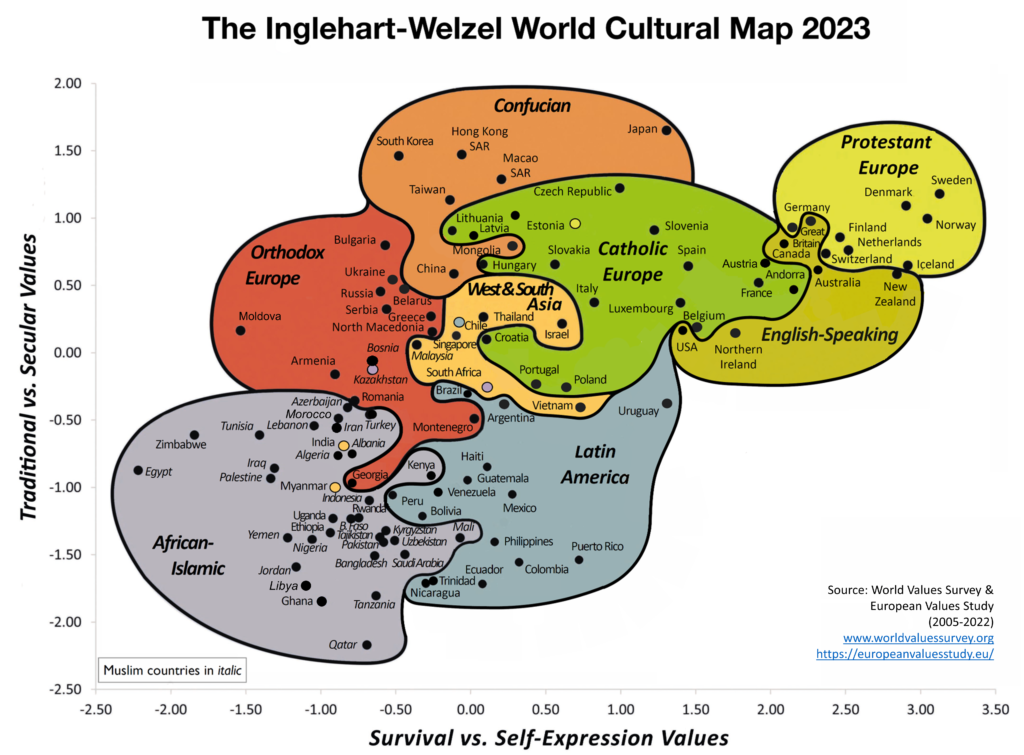

When we delve a little into the characteristics of each nation, more precisely into their similarities and differences in beliefs, values and culture, we see that there are groups of nations that share cultural similarities and values with each other, unlike other groups.

According to Inglehart and Welzel’s periodically published world cultural map, these divisions can be observed, which also contributes to a greater understanding of historical conflicts and the understanding and prediction of some current conflicts. The subject is not new; Samuel P. Huntington in his 1996 work “Clash of Civilization” had already looked at the intrinsic differences between nations and their interactions, while describing the possibilities of global political evolution.

Figure 1-Source: worldvaluessurvey, 2023

Technology

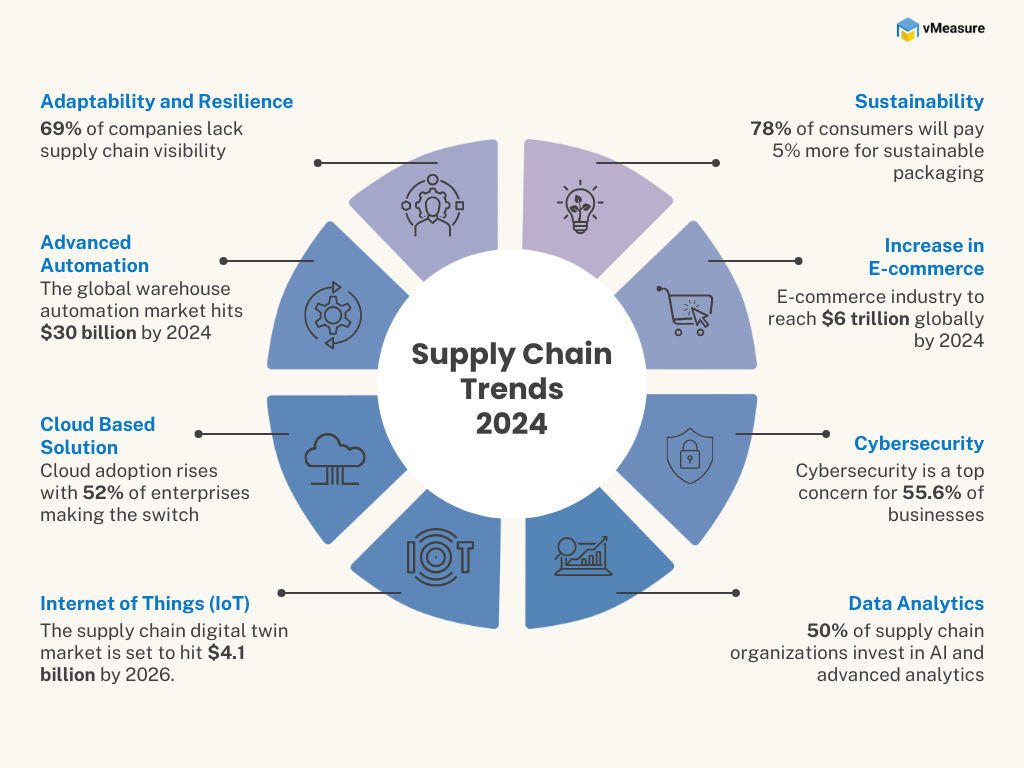

The theme whose likelihood and impact are high, set out by the report, is the strengthening of the digital supply chain. The conversion of data from physical to digital format enables the Internet of Things (IoT), artificial intelligence, blockchain and smart contracts, cloud-based solutions and countless other emerging technologies that depend on high-quality digital inputs. More supply chain organizations will transform their networks into connected, intelligent, scalable, customizable and agile digital ecosystems. Some will achieve a holistic digital transformation, while others will move more slowly, balancing long-term investment in automation with the immediate implementation of solutions that reduce repetitive tasks and cognitive fatigue, allowing employees to focus on areas where humans outperform machines.

This corroborates the Dimensional Scanner study from January 2024[2], in which we highlighted, without relegating the others to second place, the need to focus on resilience and sustainability. In terms of resilience, a lack of visibility of your entire supply chain can lead to operational inefficiencies and limit your ability to deal with disruptions. We see that a focus on dynamic inventory management, processes supported by FP&A and adequate market intelligence contributing to the correct diversification of suppliers and collaborative partnerships, combined with continuous learning, can facilitate adaptability in the supply chain.

Figure 2-Source: dimensaionscanner, 2024

Another relevant trend is the increased use of supply chain analysis with the use of technology, including the exchange of standardized freight data to provide operational efficiencies, route optimization and port planning, as well as enabling the reduction of emissions and various costs. Other applications include more accurate demand forecasting, assisting the sales and marketing sectors, which will facilitate inventory management and, consequently, the customer experience (UX), causing a cascading effect on product performance.

FP&A as a lever for development

We note that financial planning and analysis (FP&A) can play a crucial role in this context. FP&A can help organizations integrate financial data with operational data, providing a more comprehensive view of supply chain performance. This makes it easier to identify trends and forecast future needs, allowing for better allocation of resources and investments. With detailed financial insights, companies can make more informed decisions, balancing long-term investment in automation with the immediate implementation of solutions that reduce repetitive tasks and cognitive fatigue, allowing employees to focus on areas where humans outperform machines.

The resilience of global inflation is directly linked to the efficiency of supply chains and companies’ ability to adapt to new economic challenges. By using big data and FP&A, organizations can mitigate the effects of inflation by optimizing costs and improving operational efficiency. In the context of the energy transition, this capacity for analysis and planning is essential to tackle emerging difficulties and trends. The transition to cleaner and more sustainable energy sources involves significant investments and complex operational changes. FP&A can help balance these investments with the need to maintain competitiveness and profitability in the short term, while supporting long-term transformation.

The energy transition brings with it challenges such as volatile energy prices, the need to develop new infrastructure and adapt to regulatory policies. With a robust FP&A approach, organizations can plan for these transitions more effectively, predicting financial and operational impacts, and implementing strategies that minimize risks and maximize opportunities. In this way, by strengthening their supply chains and improving financial resilience, companies will be better positioned to face both inflationary pressures and the demands of the global energy transition.

Our Vision

Although it is unlikely that friction will occur between companies that share characteristics of heterogeneity and power in the supply chain in the short term, if it does happen, it is very likely that the impact will be felt globally and in a cascading effect. This impact would be more significant in sectors and companies with greater exposure to supplier risk (such as scarcity of sources) and, above all, in those that do not have adequate financial provision to maintain resilience.

Companies’ understanding of cultural factors between nations remains an essential element for business relations, market expansion and competition. This makes it possible to predict and mitigate the risks arising from political decisions with geopolitical repercussions.

In a scenario where there is friction between heterogeneous societies, all of them which play important roles in the supply chain, it is reasonable to imagine that their ability to adapt must be rapid, otherwise they will suffer a more severe impact. Cost optimization and management, as well as the broader vision provided by the application of FP&A (Financial Planning, Budgeting and Analysis) concepts and the appropriate use of market intelligence, will make it possible to consolidate the sustainable growth of business activities.

[1] https://www.ascm.org

[2] https://dimensionalscanner.com

—————————————————————————————————————–

The aim of this report is to provide a succinct and comprehensive analysis, contributing to the readers’ study and providing insights to better understand the environment and make informed decisions.